Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

2022-12-15 • Updated

Walmart is one of the biggest retail corporations in the US, with $244 billion in total assets. Does it worth buying amid rising prices and supply concerns that shatter the world economy? We decided to analyze Walmart ahead of the upcoming earnings report.

Walmart has performed well since the stock market crash in March 2020, gaining 55% over the last years. It may seem not much, but Walmart is a retail company that resists volatility. Average spending grew across 2020 and 2021, rising by 22% and then by an additional 2%. Store sales felt great, too, increasing by 6% through late 2021. Sounds great, but there is a serious concern about future earnings.

The E-commerce segment is likely to be a stumbling block this year as the recession comes to the world’s economy. Shops are moving away from digital spending as Covid-19 becomes a regular flu-like disease and people are no longer locked in their homes.

To fight back the market share, Walmart needs to increase its popularity among US citizens and decrease its dependence on digital shopping (or increase its quality). That will be a major challenge because Walmart’s closest rival – Target – is gaining speed due to better supply chains and pricing policies. That’s why Target is able to post lower revenues but higher profit margins. But Target has only 2000 stores against Walmart’s 11 000, so we have a more worthy opponent – Amazon.

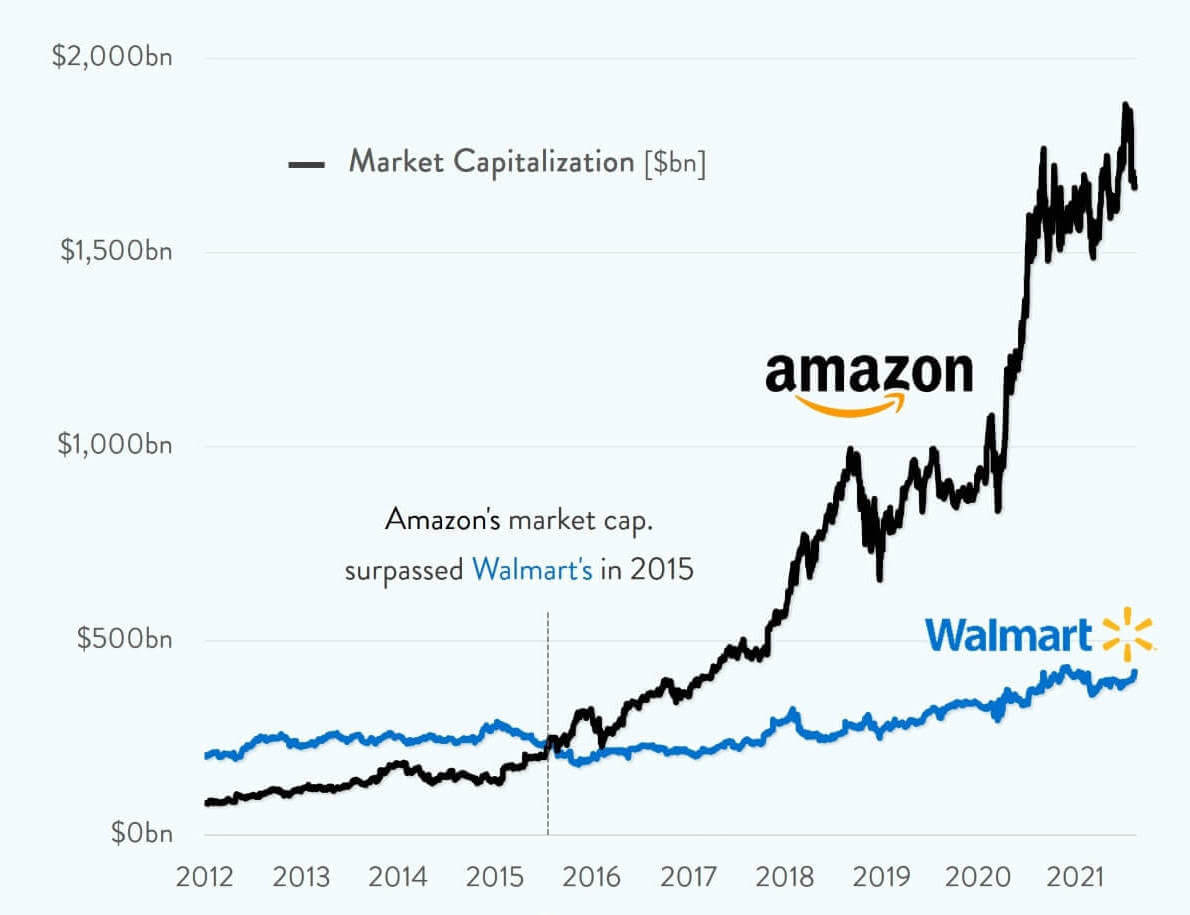

Amazon surpassed Walmart’s market capitalization in 2015 and has been on the top since then. Walmart has a far worse digital segment and scalability. Can the company change the game and be a first?

Probably, the miracle won’t happen, and Walmart will perform poorly in the earnings report. Not only the company fails to compete with its closest rivals, but other factors are pressing on it.

Walmart likely faced soaring costs in areas like transportation and wages. It has been hard to keep employee turnover low in this tight labor market. And the chain might be seeing a demand shift away from some high-margin products, like home furnishings and apparel, as consumers prioritize spending on essentials.

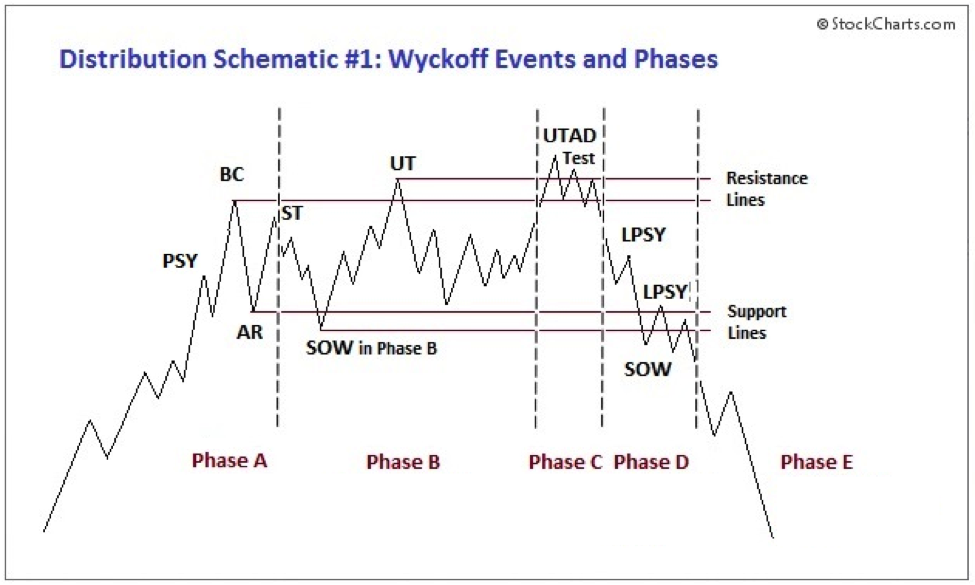

The chart signals the same. Did you know about the Wyckoff distribution model? It tells us about an upcoming recession in the asset. Please take a look at it.

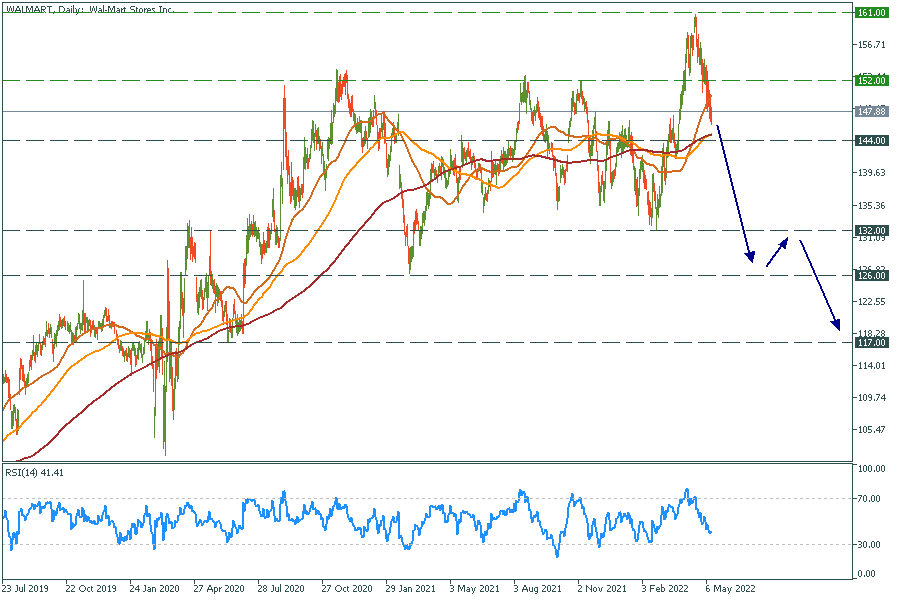

And now look at Walmart’s chart. The chart and the model look almost the same. Thus, we expect Walmart to show worse than expected earnings results and go lower to the support area at $132-126.

Walmart daily chart

Resistance: 152.00, 161.00

Support: 144.00, 132.00, 126.00, 117.00

Walmart will release its earnings report on May 17, before the market opens. Analysts expect EPS of $1.46 and revenue of $138.12 billion.

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

During his program on CNBC on February 28, Jim Cramer expressed frustration with the impact of earnings reports on market behavior, noting how they often prompt rash decisions by average investors. He criticized the short-term focus and lack of attention to nuance in news coverage of earnings. Cramer cited examples of Home Depot and Lowe's, highlighting how investors reacted hastily to headline news without considering the broader context provided in earnings calls.

As the year winds down and the festive spirit takes hold, the stock market often presents a curious yet anticipated phenomenon known as the Santa Rally. Within this whirlwind of festive trading, let’s look at how two titans of the tech world, Amazon and Apple, might fare during this unique season.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!